Enhancing Business Efficiency Through Modern Payroll Solutions

Understanding Payroll Challenges in Hong Kong

Managing employee compensation in Hong Kong presents unique challenges due to strict labor regulations, tax obligations, and a diverse workforce. Ensuring accurate and timely payroll processing is essential for maintaining employee satisfaction and compliance with statutory requirements. Companies in Hong Kong are increasingly exploring professional solutions to streamline payroll management, reduce administrative burdens, and mitigate risks associated with errors or non-compliance.

Key Roles of Payroll Management

Payroll management encompasses more than simply issuing salaries. It involves several critical functions:

- Calculation of Wages and Benefits: Accurately computing salaries, overtime, bonuses, and deductions.

- Compliance and Tax Filing: Ensuring adherence to Hong Kong’s Inland Revenue Department requirements and statutory obligations like MPF contributions.

- Record Keeping: Maintaining precise employee records for audit, reporting, and legal compliance.

- Analytics and Reporting: Providing insights into payroll costs, trends, and workforce efficiency.

Outsourcing payroll allows businesses to delegate these complex responsibilities to experts, reducing errors and ensuring timely delivery.

Advantages of Using Professional Payroll Services

Engaging a payroll services provider for payroll management brings numerous benefits:

- Increased Accuracy: Experts minimize errors in calculations and prevent costly mistakes.

- Regulatory Compliance: Staying up to date with local labor laws and taxation requirements.

- Time and Cost Savings: Reducing internal administrative work and associated overheads.

- Employee Trust and Satisfaction: Ensuring employees receive accurate and timely compensation.

Choosing the Right Payroll Provider in Hong Kong

Selecting an experienced payroll provider is crucial to maximize benefits. Companies should consider:

- Local Expertise: Understanding Hong Kong-specific labor regulations and tax policies.

- Technological Capabilities: Leveraging automated payroll systems for efficiency and accuracy.

- Service Customization: Tailoring solutions to the organization’s size, industry, and workforce composition.

- Support and Responsiveness: Providing prompt assistance for employee inquiries and payroll issues.

See also: The Rise of Quantum Computing: A Game Changer in Technology

Common Payroll Challenges in Hong Kong

Internal payroll management can present several obstacles, including:

- Complex Legal Requirements: Complying with evolving labor laws and tax rules.

- Data Security Risks: Protecting sensitive employee information.

- Integration Difficulties: Ensuring payroll systems work seamlessly with HR and accounting software.

- Scalability Issues: Handling payroll efficiently during periods of growth or workforce fluctuations.

Outsourcing payroll solutions helps businesses overcome these challenges while reducing operational risk.

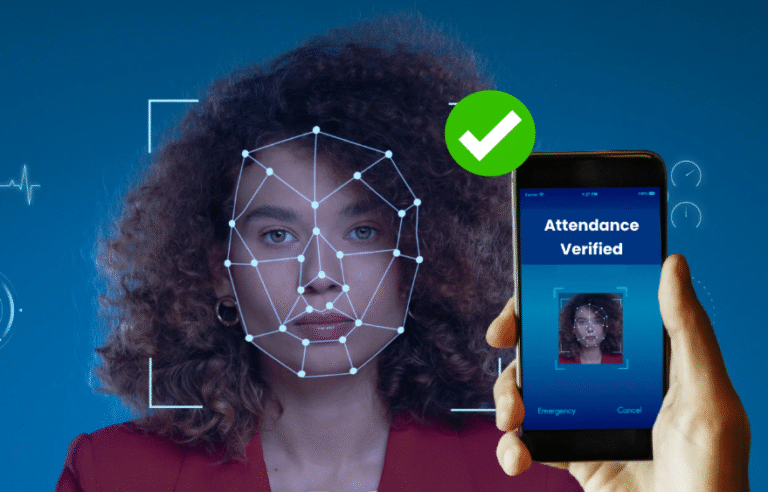

Leveraging Technology for Payroll Efficiency

Modern payroll solutions in Hong Kong use advanced technology to enhance accuracy and efficiency. Cloud-based platforms allow real-time access to payroll information for HR teams and employees. Automation simplifies calculations, tax filings, and statutory contributions, freeing HR professionals to focus on strategic initiatives rather than repetitive administrative tasks.

Strategic Benefits Beyond Payroll Processing

Professional payroll services provide more than just operational efficiency. They offer strategic advantages that contribute to business growth:

- Data-Driven Decisions: Payroll reports provide insights for workforce planning and budgeting.

- Focus on Core HR Functions: Enabling HR teams to prioritize talent acquisition, training, and engagement.

- Risk Mitigation: Reducing compliance-related penalties and operational risks.

- Scalability and Flexibility: Adapting payroll processes to business growth and seasonal workforce changes.

Best Practices for Implementing Payroll Services

Implementing professional payroll solutions requires careful planning:

- Assess Current Processes: Identify inefficiencies and areas for improvement.

- Define Objectives: Set goals such as accuracy, compliance, and cost-effectiveness.

- Select the Right Provider: Choose a provider with local expertise and advanced technology.

- Plan the Transition: Ensure smooth data migration, staff training, and system integration.

- Monitor and Optimize: Regularly review service performance and make necessary adjustments.

Future Trends in Payroll Management

The future of payroll in Hong Kong is shaped by digitalization, automation, and artificial intelligence. Companies adopting professional solutions can benefit from predictive analytics, automated compliance updates, and cloud-based platforms that enhance security and accessibility. These advancements enable businesses to maintain operational efficiency, reduce risks, and improve employee satisfaction.

Conclusion

Efficient payroll management is essential for businesses in Hong Kong to ensure regulatory compliance, accurate compensation, and workforce satisfaction. Partnering with professional payroll providers allows organizations to reduce administrative burdens, minimize errors, and focus on strategic growth. By leveraging advanced technology and specialized expertise, companies can optimize payroll operations, improve workforce efficiency, and prepare for sustainable business success.